In an progressively interconnected world financial system, organizations functioning in the Middle East and Africa (MEA) face a diverse spectrum of credit rating dangers—from unstable commodity costs to evolving regulatory landscapes. For economical institutions and corporate treasuries alike, robust credit rating risk management is not only an operational necessity; It is just a strategic differentiator. By harnessing exact, well timed information, your global threat management crew can renovate uncertainty into opportunity, ensuring the resilient development of the businesses you assistance.

1. Navigate Regional Complexities with Self esteem

The MEA area is characterized by its economic heterogeneity: oil-pushed Gulf economies, source-prosperous frontier markets, and speedily urbanizing hubs across North and Sub-Saharan Africa. Every single current market provides its very own credit score profile, legal framework, and forex dynamics. Info-pushed credit rating chance platforms consolidate and normalize data—from sovereign ratings and macroeconomic indicators to individual borrower financials—enabling you to definitely:

Benchmark threat throughout jurisdictions with standardized scoring types

Recognize early warning alerts by tracking shifts in commodity price ranges, FX volatility, or political risk indices

Enrich transparency in cross-border lending decisions

2. Make Knowledgeable Conclusions by Predictive Analytics

As an alternative to reacting to adverse occasions, main institutions are leveraging predictive analytics to anticipate borrower strain. By applying machine Mastering algorithms to historic and actual-time facts, you could:

Forecast probability of default (PD) for corporate and sovereign borrowers

Estimate exposure at default (EAD) beneath unique financial eventualities

Simulate decline-given-default (LGD) making use of recovery costs from previous defaults in very similar sectors

These insights empower your workforce to proactively regulate credit limits, pricing methods, and collateral needs—driving greater chance-reward outcomes.

3. Improve Portfolio General performance and Cash Effectiveness

Correct information permits granular segmentation within your credit rating portfolio by sector, region, and borrower sizing. This segmentation supports:

Hazard-modified pricing: Tailor interest fees and charges to the specific possibility profile of every counterparty

Focus monitoring: Restrict overexposure to any single sector (e.g., Electrical power, building) or country

Funds allocation: Deploy financial money more successfully, lowering the expense of regulatory capital underneath Basel III/IV frameworks

By continuously rebalancing your portfolio with facts-pushed insights, it is possible to improve return on chance-weighted belongings (RORWA) and release money for expansion possibilities.

4. Bolster Compliance and Regulatory Reporting

Regulators through the MEA location are more and more aligned with world-wide benchmarks—demanding rigorous tension testing, situation Examination, and clear reporting. A centralized data System:

Automates regulatory workflows, from data selection to report technology

Makes sure auditability, with full data lineage and alter-administration controls

Facilitates peer benchmarking, comparing your institution’s metrics against regional averages

This reduces the potential risk of non-compliance penalties and boosts your name with both equally regulators and traders.

5. Greatly enhance Collaboration Throughout Your World-wide Threat Group

Having a unified, data-pushed credit risk administration method, stakeholders—from entrance-Business office connection managers to credit rating committees and senior executives—acquire:

Serious-time visibility into evolving credit score exposures

Collaborative dashboards that emphasize portfolio concentrations and anxiety-examination results

Workflow integration with other possibility functions (market place danger, liquidity chance) for a holistic company hazard see

This shared “solitary source of real truth” eliminates silos, accelerates selection-building, and fosters accountability at each degree.

6. Mitigate Emerging and ESG-Relevant Challenges

Further than traditional fiscal metrics, modern-day credit history hazard frameworks include environmental, social, and governance (ESG) things—vital inside a location where sustainability initiatives are attaining momentum. Facts-driven resources can:

Rating borrowers on carbon depth and social affect

Model changeover challenges for industries Credit Risk Management exposed to shifting regulatory or customer pressures

Support environmentally friendly financing by quantifying eligibility for sustainability-joined financial loans

By embedding ESG information into credit history assessments, you not simply foreseeable future-proof your portfolio and also align with world-wide Trader expectations.

Summary

Inside the dynamic landscapes of the center East and Africa, mastering credit possibility management calls for more than intuition—it requires rigorous, facts-driven methodologies. By leveraging correct, in depth info and advanced analytics, your world-wide risk management crew will make nicely-knowledgeable selections, improve cash use, and navigate regional complexities with self-confidence. Embrace this technique now, and remodel credit score threat from a hurdle into a competitive advantage.

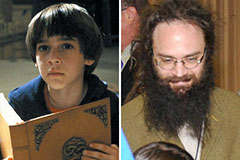

Barret Oliver Then & Now!

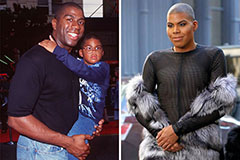

Barret Oliver Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!